For centuries, wish notes have captured our dreams and desires. These small pieces of paper are powerful. They show what people hope for, throughout history. Join us as we uncover the evolution of these fascinating notes. Today, wish notes have taken on a new form with the rise of “travel wish notes“. These notes are often found in places like the Wailing Wall in Jerusalem or the love lock bridges in Paris, where people write their travel aspirations and affix them to the walls or fences. The concept of these notes has evolved to include not just personal wishes, but also the collective dreams of exploring the world.

Key Takeaways:

- Wish notes have a long history that spans many years.

- They capture individual dreams and hopes.

- Over time, wish notes have changed, reflecting new cultures and technologies.

- Writers and artists work together, making wish notes come to life.

- The book “I Wish You More” highlights how strong wishes can be and the magic of stories.

The Introduction of Cheques as Wish Notes

In the 13th century, a revolutionary form of wish notes came to be. These wish notes, known as cheques, changed how money transactions worked. They made paying for things easy and safe.

Cheques started as a way to help international business run smoother. Instead of carrying cash, people wrote cheques. This let them tell their bank to pay someone without handling money themselves. Cheques made business dealings far easier.

Cheques got popular because they were convenient and secure. People didn’t have to carry a lot of cash, making things safer. They also made it simple to keep track of money spent or received.

Cheques helped trade and business grow. They made transactions faster and cut down on the need for cash. This helped businesses get bigger and trade more across borders.

As cheques became more popular, technology made them safer. New designs included watermarks, holograms, and magnetic ink. These features fought against fraud and fake cheques.

Cheques changed financial systems for the better. They offered a way to pay that was easy, secure, and easy to track. This was a big step forward for business and finance.

The Evolution of Cheque Design and Security

Banking practices got more organized, leading to printed cheques. Banks would print cheques for customers to complete themselves. These developments included more security features to fight fraud and improve safety. This is how cheques continued to be useful and secure.

The Evolution of Cheque Design

Cheques changed a lot from just being handwritten notes. They now have complex design features to prevent fraud and confirm their realness. Some important features of cheque design are:

- Watermarks: Embedded markings that are visible when held to the light, making it difficult to replicate the cheque.

- Holograms: Three-dimensional images that change when viewed from different angles, providing an additional layer of security.

- Microprinting: Tiny text that is only visible under magnification, making it difficult to counterfeit.

- Security threads: Embedded threads that are visible under ultraviolet light, helping to verify the authenticity of the cheque.

These features help protect against forgery and ensure safe financial dealings.

Enhancing Cheque Security

Cheque security has seen big improvements with new technology. Key security features now include:

- Chemical alteration detection: Incorporating special chemicals that react to alteration attempts, making it evident if the cheque has been tampered with.

- Biometric authentication: Utilizing biometric data such as fingerprints or facial recognition to verify the identity of the cheque issuer.

- QR codes: Including Quick Response (QR) codes on cheques, which can be scanned to access additional information and verify the cheque’s legitimacy.

- Data encryption: Employing strong encryption algorithms to protect sensitive information during transmission and storage.

By improving design and security, banks work hard to beat fraudsters and ensure a safe payment option for everyone.

| Common Cheque Design Features | Enhanced Cheque Security Measures |

|---|---|

| Watermarks | Chemical alteration detection |

| Holograms | Biometric authentication |

| Microprinting | QR codes |

| Security threads | Data encryption |

The Rise and Decline of Cheque Usage

The way we pay has changed, leading to fewer cheques being used. Cheques have seen a 54% drop in use over the last decade. In the US, their use has fallen by 67% in the same time.

Big businesses are using 73% fewer cheques than they did ten years ago. Small businesses are also using less, with a 48% decrease.

Banks are noticing they process 61% fewer cheques every day. People are writing 45% fewer cheques each year than they used to.

Digital payments are becoming more popular, causing the drop in cheque use. Mobile payments by millennials have soared 126% in five years.

Contactless payments are more common, with a 95% increase in use last year.

Online banking’s ease has led to an 80% jump in daily transactions. This shows a move towards digital payments.

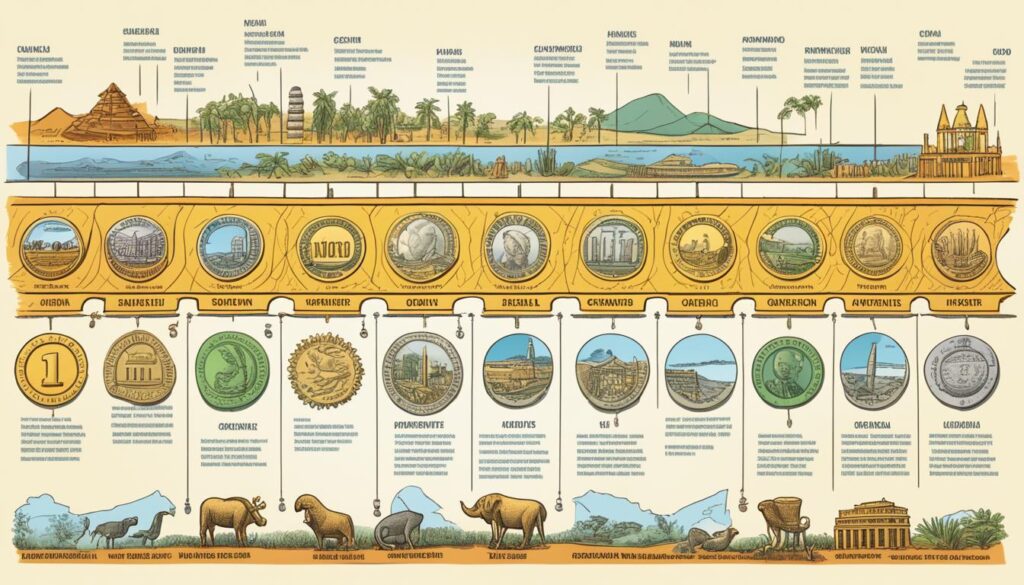

The Birth of National Currency in Ghana

After gaining independence, Ghana worked to create its own national currency. Before independence, the West African Currency Board was in charge of Ghana’s currency. The newly formed Bank of Ghana took over this role, aiming for economic freedom.

In 1958, Ghana launched its first national currency: the Ghana pounds, shillings, and pence. This was a big moment for Ghana’s economy, showing the country’s move toward economic freedom.

The new national currency was a symbol of Ghana’s freedom and identity. It marked the beginning of a new era, moving away from colonial rule. Ghana was now on its way to building its own economic future.

The national currency’s introduction was key in building Ghana’s financial system. It let the government manage the economy and set unified monetary policies.

Over time, Ghana’s currency has evolved with the economy and technology. Today, it is crucial for trade, investment, and daily life in Ghana.

| Year | Event |

|---|---|

| 1958 | Introduction of Ghana pounds, shillings, and pence |

| 1957 | Bank of Gold Coast divided into Bank of Ghana and Ghana Commercial Bank |

| 1989 | Passing of the Banking Law, allowing the establishment of privately-owned banks |

Ghana’s Financial Sector

The creation of its currency set the stage for Ghana’s strong financial sector. Now, Ghana’s financial industry offers a wide range of services. It meets the needs of people and businesses.

Banks like the Bank of Ghana, GCB Bank LTD., Ecobank, and CAL Bank are major players. Rural banks, microfinance, and forex services also boost the financial system. They make the economy diverse.

Ghana focuses on growing its financial sector for better economic growth and stability. A well-managed financial system helps its people, attracts investments, and supports sustainable development.

The Introduction of the Cedi

In 1965, Ghana experienced a major change. It introduced the cedi as its new currency, leaving behind the old system of Ghana pounds, shillings, and pence.

The cedi was based on the decimal system. It replaced the old currency at a rate of eight shillings and four pence. This change made money matters simpler in Ghana and helped the economy grow.

Choosing the cedi was a big step towards updating Ghana’s money system. It matched international standards better. This helped the country’s economy become more stable and boosted trade.

Since its start, the cedi has changed multiple times. These changes were due to things like inflation and new economic policies. They aimed to keep up with Ghana’s growing economy.

Today, the cedi is still Ghana’s currency. It has been vital for the nation’s economic growth. Its start was a key event in Ghana’s money history. It laid the groundwork for future improvements.

| Year | Event |

|---|---|

| 1965 | Introduction of the cedi as Ghana’s new currency |

| 1978 | Issuance of the 20 cedi note (¢20.00) |

| 1977-1982 | Alexander Eric Ashiagbor serves as Governor of the Bank of Ghana |

The New Cedi and Currency Demonetization

In 1967, Ghana introduced the New Cedi to transform its money. The New Cedi took the spot of the old currency. This currency showed Ghana’s first president, Dr. Kwame Nkrumah. The goal was to update Ghana’s financial system with the times.

But the changes didn’t stop with the New Cedi. In 1973, Ghana moved to use just the cedi, saying goodbye to the New Cedi. Then in 1979, Ghana faced another big change – its money was demonetized.

On March 9, 1979, Ghana took a big step by demonetizing its currency. Old Cedi notes were swapped out for new ones. People could exchange their old money for new notes at reduced rates. Up to ¢5,000 earned a 30% discount, and more than ¢5,000 got a 50% cut.

This move aimed to beat fake money, boost the economy, and stabilize the money market. By bringing in new notes, Ghana wanted to rebuild trust in its money. This was key to improving the economy.

After demonetization, Ghana saw a mix of cedi and pesewa values. Notes ranged from ¢1 to ¢5,000. Coins went from ½ P to ¢500.

The start of the New Cedi in 1967 was a big moment for Ghana’s money story. The 1979 demonetization then updated old notes to new ones at lower rates. These steps were taken to make Ghana’s money system better and to encourage economic steadiness.

| Currency Transition | Date | Exchange Rate |

|---|---|---|

| Introduction of Cedi notes and Pesewa coins | July 19, 1965 | 1 Cedi = 1.20 New Cedi |

| Introduction of the New Cedi | February 17, 1967 | 1 New Cedi = 1 Cedi |

| Currency Demonetization | March 9, 1979 | Discounted rates: 30% for amounts up to ¢5,000 and 50% for amounts exceeding ¢5,000 |

Currency Denominations in Ghana

Ghana offers a range of currency forms to support its economy and smooth transactions. It uses both notes and coins. Let’s explore Ghana’s currency forms now:

Ghanaian Notes Denominations

Notes in Ghana range from ¢1 to ¢5,000. The government launched various denominations over time for the growing economy.

Denominations like ¢1, ¢5, ¢10, ¢50, ¢100, ¢1,000, 5P, 10P, and 20P were issued in 1965.

Between 1972 and 1994, more note denominations from ¢2 to ¢5,000 were added. This included seven new notes, showing the country’s economic shift.

¢10,000 and ¢20,000 notes were introduced in 2002. These catered to bigger transactions.

Ghanaian Coins Denominations

Coin values in Ghana go from ½ P to ¢500. They are used for smaller purchases along with notes.

From 1972 to 1994, Ghana welcomed eight coin types from ¢100p to 50,000p (¢500). These cater to daily buying needs.

Ghana’s currency has adapted over time, fitting the economic changes and transaction needs.

| Note Denominations | Coin Denominations |

|---|---|

| ¢1 | ½ P |

| ¢5 | 1 P |

| ¢10 | 5 P |

| ¢50 | 10 P |

| ¢100 | 20 P |

| ¢1,000 | 50 P |

| ¢5,000 | 100 P |

| ¢10,000 | 250 P |

| ¢20,000 | 500 P |

| 1 Cedi | |

| 2 Cedis | |

| 5 Cedis | |

| 10 Cedis | |

| 20 Cedis | |

| 50 Cedis |

The Future of Wish Notes

Technology is changing how we send wish notes. In the past, we used cheques and cash. Now, digital options are becoming more common.

People are using tech more in money matters. So, digital wish notes are getting popular. Mobile payments, online banking, and digital money offer easy ways to send wishes.

One big plus of digital wishes is easy access. You can send or get wishes anywhere in the world. This makes them very handy for everyone.

But, as we use digital wishes, keeping them safe is key. The rise in cybercrime means we must protect our wishes. Technologies like blockchain and finger scanning can help.

Yet, we shouldn’t forget traditional wish notes’ value. Writing a wish by hand or giving cash has a special meaning. Keeping this tradition is important in the digital switch.

Tech advancements could add cool features to wish notes. Imagine using virtual reality to send a wish. It would add fun to our traditional wish sending.

To sum up, wish notes are going digital. But, as they change, convenience, safety, and keeping emotional value are key. The digital age is bringing exciting changes to wish notes.

Conclusion

Wish notes have changed a lot over time. They show how people adapt and how important traditions are. From simple notes to using money, they help us share our true feelings. Understanding wish notes and manifestation is a fascinating way to learn about different cultures and their beliefs. It’s incredible to see how people around the world use wish notes to manifest their desires and bring positivity into their lives. Whether it’s writing wishes on paper notes or tying them to trees, the act of manifesting our dreams and aspirations is a powerful and universal practice.

Psychology has also grown. More women are now leaders in this field. For example, Mary Jean Wright was the first female leader of the Canadian Psychological Association in 1968. This change shows how much progress we’ve made towards equality.

The work of many psychologists has helped develop our understanding of the mind. They study how we think, feel, and decide. Our behaviors are influenced by our genes and our environment.

To sum up, wish notes and psychology both show how human knowledge grows. Looking ahead, we should value diversity and seek answers to big questions. This will help us understand what influences our actions and choices.